In a significant development, the National Company Law Tribunal (NCLT) has admitted insolvency proceedings against Byju’s, leading to founder Byju Raveendran losing control over the company.

The NCLT’s decision marks a critical juncture for Byju’s, which has been grappling with financial challenges and mounting pressures from creditors. The insolvency proceedings were initiated following a series of missed payments and unresolved financial obligations, which have strained the company’s operations and growth prospects.

As a result of the NCLT’s ruling, control of Byju’s will now shift from its founder to a court-appointed insolvency professional. This move is expected to have far-reaching implications for the company, which has been a prominent player in the edtech sector.

The insolvency professional will be responsible for managing the company’s operations, addressing creditor claims, and exploring potential avenues for restructuring or selling the business. This transition in leadership aims to stabilize Byju’s financial situation and ensure the best possible outcome for its stakeholders.

The NCLT’s decision underscores the challenges that even high-profile startups can face when financial management and obligations are not adequately addressed. Byju Raveendran’s loss of control highlights the importance of robust financial planning and the potential consequences of financial distress in the competitive edtech industry.

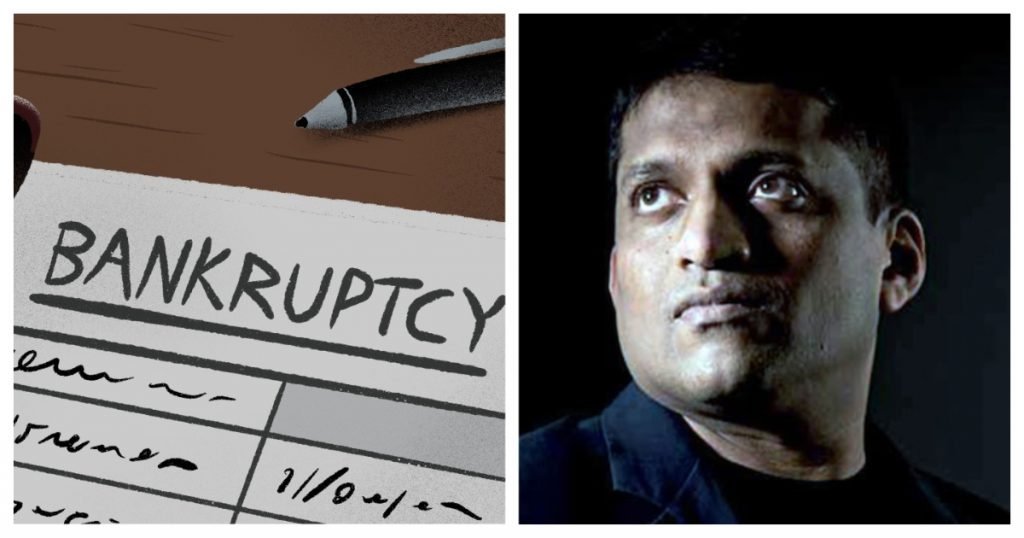

Byju’s Declared Bankrupt Amidst Legal and Financial Struggles

After several tumultuous quarters marked by conflicts with investors, customers, creditors, and even the government, Byju’s has officially entered bankruptcy.

The National Company Law Tribunal (NCLT) has admitted the Board of Control for Cricket in India’s (BCCI) petition seeking insolvency proceedings against the beleaguered ed-tech giant. The BCCI sought the initiation of these proceedings over alleged unpaid dues of ₹158 crore under their sponsorship contract for the Indian cricket team. This development signifies the fall of Byju’s, once India’s highest-valued startup.

Under the Insolvency and Bankruptcy Code (IBC), control of Byju’s will now be transferred from the current management to the company’s creditors. Furthermore, no assets of Byju’s can be transferred while the company is under the Corporate Insolvency Resolution Process (CIRP). The IBC also prohibits the initiation or continuation of any legal proceedings against Byju’s during this period.

The BCCI had taken Byju’s to court in December last year over the unpaid dues related to the Team India sponsorship. Byju’s had become the chief sponsor of the Indian national cricket team in 2019, replacing Chinese phone maker Oppo. Initially, Byju’s signed a three-year contract with the BCCI, set to last until 2022, but extended it for another year until 2023. However, Byju’s struggled to raise further funds around this time and chose to withdraw from the sponsorship. BCCI replaced Byju’s with fantasy games platform Dream11 but claimed that Byju’s still owed ₹158 crore, leading them to take Byju’s to bankruptcy court over the unpaid amount.

With Byju’s unable to pay its dues, the NCLT has now initiated insolvency proceedings against the company. Insolvency proceedings are the legal process that occurs when an individual or organization is unable to pay their debts as they become due. This process can help lenders recover dues through methods such as compulsory liquidation, restructuring, or bankruptcy.

As a result of the NCLT’s decision, Byju Raveendran has lost control of the company he founded in 2011. Unless there’s an appeal, Raveendran will no longer have a say in the business he built over a decade. The recent challenging quarters have seemingly undone years of effort, and Byju’s is now under the control of its creditors instead of its founder.