MobiKwik: Simplifying Online Recharge and Bill Payments

Published by: Shubham Kumar, Manisha Mishra

Date: Sep 19, 2023 — 19 min read

MobiKwik: A Success Story

MobiKwik is revolutionizing digital transactions in India, offering a seamless way to manage online recharges and bill payments. As a pioneer in the mobile wallet sector, MobiKwik has successfully carved out a niche despite fierce competition.

Founders: Bipin Preet Singh, Upasana Taku

Founded: 2009

Valuation: $1 Billion+

Headquarters: Gurgaon, India

Website: mobikwik.com

Company Overview:

MobiKwik began with a mission to simplify financial transactions and has evolved into one of India’s leading mobile wallets. It provides users with a digital wallet to store money and make payments across various platforms including mobile apps, desktops, and SMS.

Key Features:

- User Experience: MobiKwik offers a smooth, user-friendly interface for transactions, from mobile recharges to bill payments. The wallet supports multiple platforms such as Android, iOS, and Windows, along with desktop and mobile sites.

- Safety: The platform is highly secure, with robust in-app security features and RBI approval for operations.

- Expansion: MobiKwik has ventured into offline payments, collaborating with major retailers like Big Bazaar and Domino’s Pizza. It has also obtained approval to set up a Bharat Bill Payments Operating Unit (BBPOU).

Founders and Leadership:

- Bipin Preet Singh: Co-founder and CEO, with a background in engineering from IIT Delhi and experience in companies like Intel and Nvidia.

- Upasana Taku: Co-founder and COO, with a strong educational background from NIT Jalandhar and Stanford University. She has previously worked with HSBC and PayPal.

- Chandan Joshi: Promoted to Co-founder in September 2020, previously a business head at Credit Suisse and founder of Packetts.

Business and Revenue Model:

MobiKwik’s revenue comes from transaction commissions, partnerships, and advertisements. It also earns from cross-selling insurance and financial products. The company’s revenue distribution includes 50% from digital credit products and 50% from payment services.

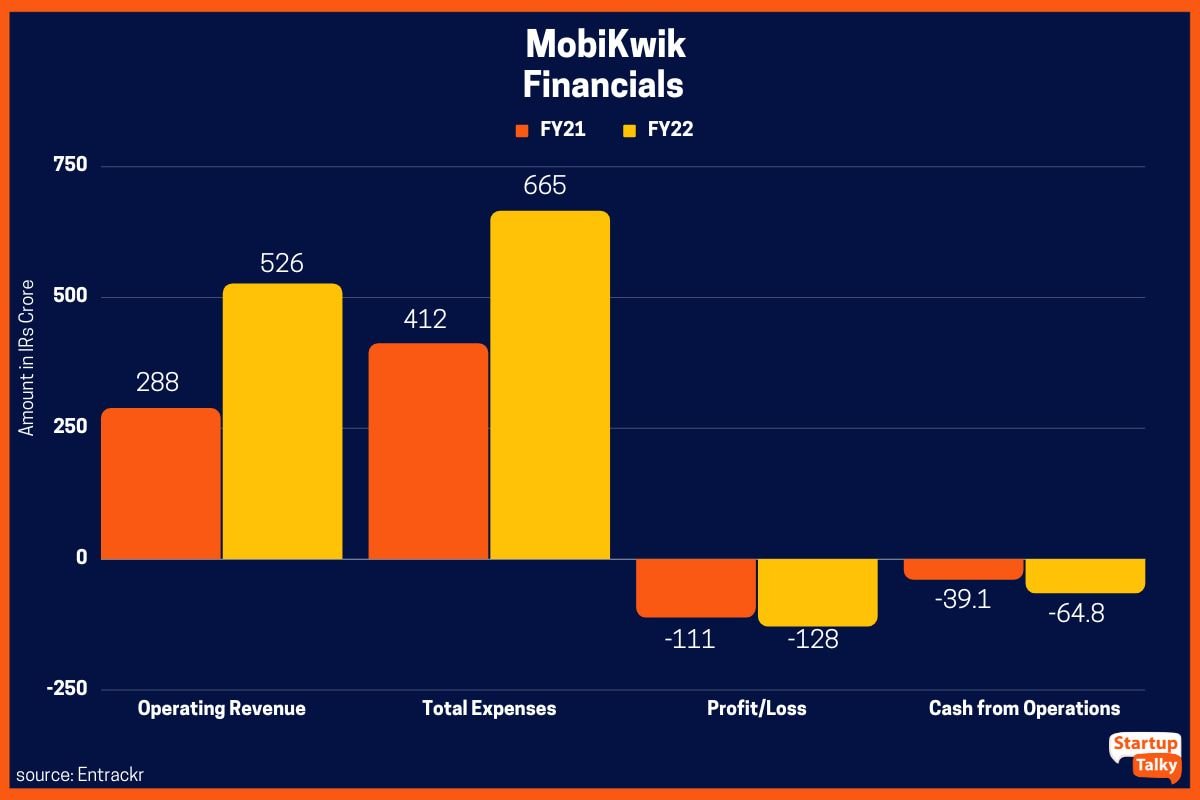

Funding and Financials:

MobiKwik has raised approximately $213.94 million in funding, with significant investments from entities like Blacksoil Capital and Sequoia Capital India. The company is preparing for an IPO and has recently achieved unicorn status.

Growth and Challenges:

MobiKwik has seen substantial growth in transactions and revenue, with notable figures in its financials. The company is addressing challenges such as operational expenses and competitive pressures while planning future expansions and innovations.

Future Outlook:

With a strong user base and ongoing expansion into new financial services, MobiKwik is positioned to remain a key player in India’s fintech landscape. The company’s strategic plans and recent funding rounds set the stage for its continued growth and development.