PolicyBazaar: The Success Story of India’s Leading Insurance Aggregator

Company Overview

Startup Name: PolicyBazaar

Headquarters: Gurugram, India

Founders: Yashish Dahiya, Alok Bansal, Manjoy Sharma, Tarun Mathur, and Avaneesh Nirjar

Sector: Fintech

Founded: 2008

Parent Organization: EtechAces Marketing and Consulting

Website: policybazaar.com

The Birth of PolicyBazaar

PolicyBazaar was conceived to address the opacity and inefficiencies in the insurance sector. The founders, particularly Yashish Dahiya, were inspired to start the platform after encountering issues with insurance mis-selling. They aimed to create a transparent, user-friendly marketplace where customers could compare, purchase, and manage their insurance policies efficiently.

Company Highlights

- Unicorn Status: PolicyBazaar achieved unicorn status on June 26, 2018, becoming the second Indian unicorn of that year.

- Growth Trajectory: PolicyBazaar has grown to become the largest platform in India for comparing and purchasing insurance policies.

How It Works

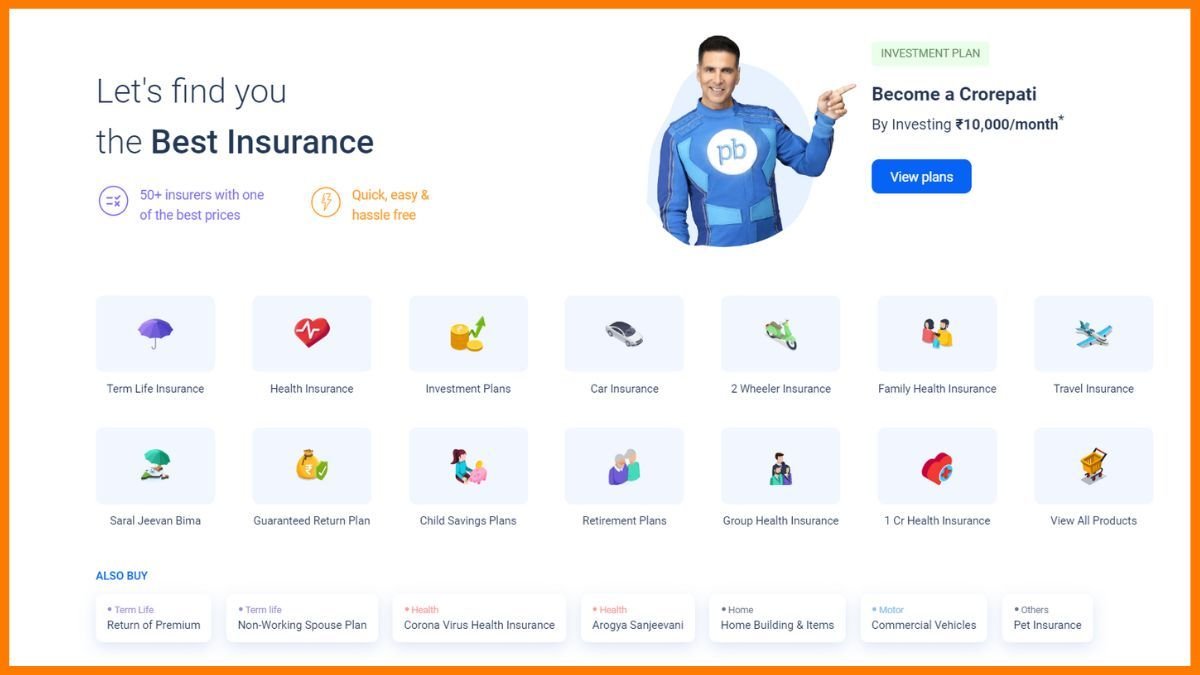

PolicyBazaar operates as a comprehensive insurance marketplace, offering a range of products including life, health, car, travel, and term insurance. With over 250 insurance plans and around 50 brands, the platform allows users to compare policies and select the best options based on their needs. Features like ‘My Account,’ self-inspection video for motor insurance, and an AI chatbot enhance user experience.

Industry Context

India’s fintech market is poised for significant growth, with insurance expected to reach $280 billion by 2021. Despite this, insurance penetration remains low, creating a substantial market opportunity for PolicyBazaar.

Founders and Team

- Yashish Dahiya: Co-founder and former CEO, holds degrees from IIT Delhi, IIM Ahmedabad, and INSEAD. He previously led First Europa and is also the founder of Paisabazaar.

- Alok Bansal: Co-founder and director, an alumnus of IIM Kolkata, previously worked in corporate strategy and finance roles.

- Avaneesh Nirjar: Co-founder, an IIT Kharagpur alumnus with experience at Marico and GE Capital.

- Tarun Mathur: Co-founder and CBO, with a background in technology and workforce management.

- Manoj Sharma: Co-founder and Director of Finance, a chartered accountant with a history in finance and accounting roles.

- Sarbvir Singh: Current CEO, previously managed WaterBridge Ventures and held senior roles at various financial institutions.

Business Model and Revenue

PolicyBazaar generates revenue through lead generation, advertising, and policy sales. Initially, most revenue came from leads and ads, but now e-commerce and policy sales constitute the majority of income.

Funding and Investments

PolicyBazaar has raised over $904.9 million across 15 funding rounds. Key investments include:

- October 6, 2023: $104.5 million in post-IPO secondary funding.

- November 23, 2020: $20 million from True North.

- May 1, 2018: $200 million from SoftBank and InfoEdge.

IPO and Stock Performance

PolicyBazaar’s IPO went live on November 1, 2021. The shares were listed at a 17.35% premium, with the stock price increasing by 22.74% from the issue price, valuing the company at $7.27 billion.

Growth and Revenue

PolicyBazaar has become the largest insurance aggregator in India, with over 100 million annual visitors and more than 300,000 transactions per month. The company has a significant market share in both life and health insurance sectors.

Financial Performance

- Revenue: Increased from Rs 1,425 crore in FY22 to Rs 2,558 crore in FY23.

- Losses: Expanded from Rs 833 crore in FY22 to Rs 488 crore in FY23.

- Expenses: Rose from Rs 2,384 crore in FY22 to Rs 3,304 crore in FY23.

Future Outlook

With continued investment in technology and customer experience, PolicyBazaar aims to further solidify its position as a leader in the Indian insurance market.

Awards and Recognition

PolicyBazaar has been recognized for its innovation and impact in the insurance sector, contributing to its status as a major player in the fintech industry.